All Categories

Featured

Table of Contents

The are entire life insurance coverage and global life insurance coverage. The money value is not included to the fatality advantage.

The plan car loan passion rate is 6%. Going this course, the passion he pays goes back into his plan's cash value rather of a monetary institution.

Cibc Aerogold Visa Infinite Online Banking

Nash was a finance professional and follower of the Austrian college of business economics, which promotes that the worth of goods aren't clearly the outcome of conventional economic frameworks like supply and need. Instead, individuals value money and items differently based on their financial condition and requirements.

One of the risks of traditional financial, according to Nash, was high-interest prices on fundings. Long as financial institutions set the rate of interest rates and funding terms, individuals didn't have control over their own riches.

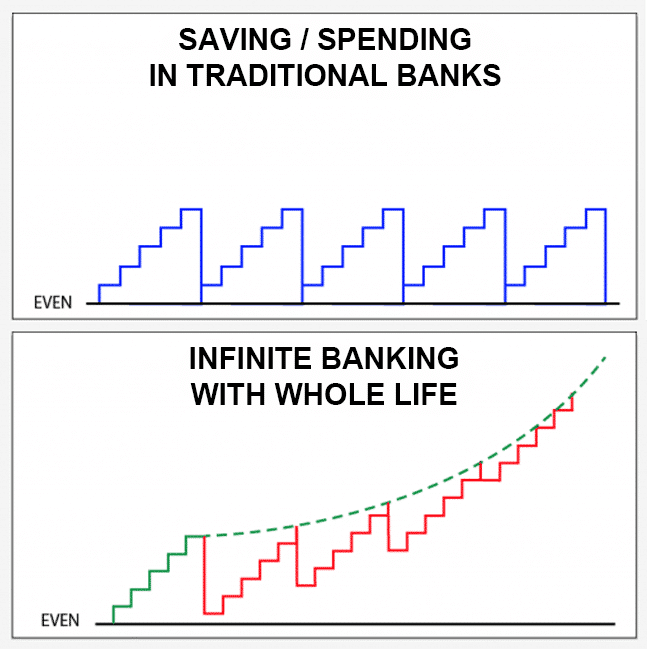

Infinite Banking needs you to have your economic future. For ambitious individuals, it can be the best economic tool ever before. Right here are the advantages of Infinite Banking: Perhaps the single most valuable element of Infinite Banking is that it boosts your cash money flow.

Dividend-paying whole life insurance policy is extremely low danger and supplies you, the policyholder, a wonderful deal of control. The control that Infinite Financial offers can best be organized into 2 categories: tax benefits and asset securities.

Your Own Banking System

When you utilize entire life insurance policy for Infinite Financial, you participate in a personal agreement in between you and your insurer. This privacy provides specific asset defenses not discovered in various other monetary lorries. Although these protections might vary from one state to another, they can consist of defense from property searches and seizures, security from reasonings and security from creditors.

Entire life insurance coverage plans are non-correlated assets. This is why they function so well as the monetary structure of Infinite Financial. No matter of what takes place in the market (stock, actual estate, or otherwise), your insurance coverage plan maintains its well worth.

Market-based financial investments grow riches much quicker yet are subjected to market changes, making them inherently high-risk. What happens if there were a third container that offered safety and security however likewise moderate, guaranteed returns? Entire life insurance policy is that 3rd pail. Not only is the rate of return on your whole life insurance coverage plan assured, your survivor benefit and premiums are also guaranteed.

This framework straightens flawlessly with the principles of the Continuous Wealth Approach. Infinite Financial interest those seeking higher monetary control. Right here are its major advantages: Liquidity and ease of access: Policy financings give immediate access to funds without the limitations of standard small business loan. Tax obligation performance: The cash worth grows tax-deferred, and policy fundings are tax-free, making it a tax-efficient tool for constructing wealth.

Benefits Of Infinite Banking

Asset defense: In several states, the cash money value of life insurance policy is shielded from creditors, including an added layer of financial safety. While Infinite Banking has its advantages, it isn't a one-size-fits-all remedy, and it features considerable disadvantages. Here's why it may not be the best technique: Infinite Financial usually needs complex plan structuring, which can confuse insurance policy holders.

Envision never ever having to worry about bank financings or high rate of interest prices once more. That's the power of unlimited banking life insurance policy.

There's no collection loan term, and you have the flexibility to pick the settlement routine, which can be as leisurely as settling the funding at the time of fatality. This versatility expands to the maintenance of the finances, where you can decide for interest-only repayments, keeping the lending equilibrium flat and convenient.

Holding cash in an IUL taken care of account being credited interest can usually be much better than holding the cash on deposit at a bank.: You've always dreamed of opening your own pastry shop. You can borrow from your IUL policy to cover the preliminary expenditures of renting a room, purchasing tools, and hiring team.

Royal Bank Infinite Avion Rewards

Individual car loans can be acquired from standard banks and credit unions. Borrowing cash on a credit score card is generally really expensive with yearly portion prices of interest (APR) commonly getting to 20% to 30% or even more a year.

The tax obligation therapy of plan finances can differ substantially depending upon your country of house and the particular terms of your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy finances are usually tax-free, offering a considerable benefit. In various other jurisdictions, there might be tax effects to take into consideration, such as possible tax obligations on the finance.

Term life insurance policy just offers a fatality benefit, with no money value accumulation. This means there's no money worth to borrow against. This post is authored by Carlton Crabbe, President of Funding permanently, an expert in providing indexed universal life insurance coverage accounts. The info supplied in this article is for academic and informational objectives just and need to not be interpreted as economic or financial investment guidance.

However, for lending officers, the comprehensive policies enforced by the CFPB can be seen as troublesome and limiting. Initially, funding police officers commonly suggest that the CFPB's regulations develop unneeded red tape, leading to even more documentation and slower funding handling. Regulations like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) demands, while focused on shielding customers, can lead to hold-ups in shutting bargains and enhanced functional expenses.

Latest Posts

Privatized Banking Policy

Life Insurance - Create Your Own Bank - Prevail

Be Your Own Bank [Top 7 Benefits Of Being Your Own Banker]